AG49A – Frankenstein Lives

Like the road to hell, AG49’s original path was paved with good intentions. Its stated aim was to alleviate confusion by creating uniformity among IUL illustrations plus additional disclosures to aid in consumer understanding.

As a client-facing insurance agent myself, I can tell you first-hand these marks were completely missed.

“Uniformity” and “consumer understanding” are so far removed from today’s AG49-A illustrations that even seasoned industry vets are befuddled. Let’s walk down memory lane to see where AG49 went astray and discuss how to rectify its bastardization.

Before the monster of AG49 was given life, a group of insurance companies cried foul on Indexed Universal Life insurance carriers playing fast and loose with illustrations using unsustainable caps and growth trajectories. The most egregious instances cherry-picked slices of history while overlaying IUL caps their options budget couldn’t possibly sustain.

A task force of actuaries from both sides of the insurance aisle (companies who did/didn’t sell IUL) worked to compromise on formulas ensuring these 3 tenets for IUL illustrations:

- Determining the maximum allowable illustration rates

- Limiting the amount of illustrated policy loan leverage

- Requiring additional disclosures to aid in consumer understanding

AG49 first went into effect on September 2015, and everyone adapted to the new illustrations.

“It’s alive, it’s ALIVE!”

The task force confidently checked the first 2 boxes above. However, their solution for box #3 about aiding in “consumer understanding” fell well short. They simply mandated a mid-point illustration be shown with steady crediting between 0% and the AG-49 maximum. It’s important to examine how poorly this 3rd tenet was addressed because our solution lives here.

First, most carriers were already illustrating some version of a midpoint, so there was nothing “additional” about it.

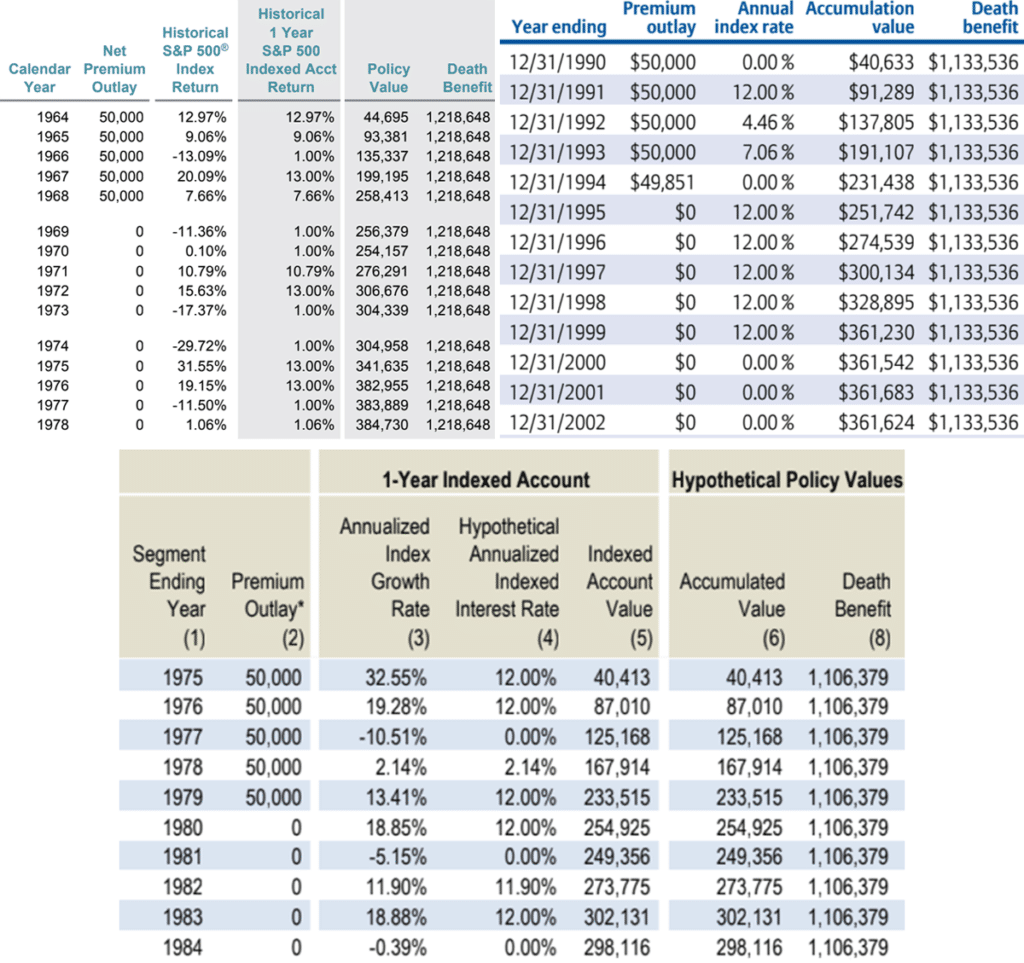

Second, prior to AG49 several IUL carriers offered historically back-tested supplemental reports, where the consumer could clearly see the effect of their policy’s cap, floor, charges, and loan interest during up and down years. Since that baby got thrown out with the bathwater, AG49 actually removed tools which previously aided in consumer understanding of the variability inherent in IUL.

After the doctor walked away from his creation, the monster’s claimed its first victim.

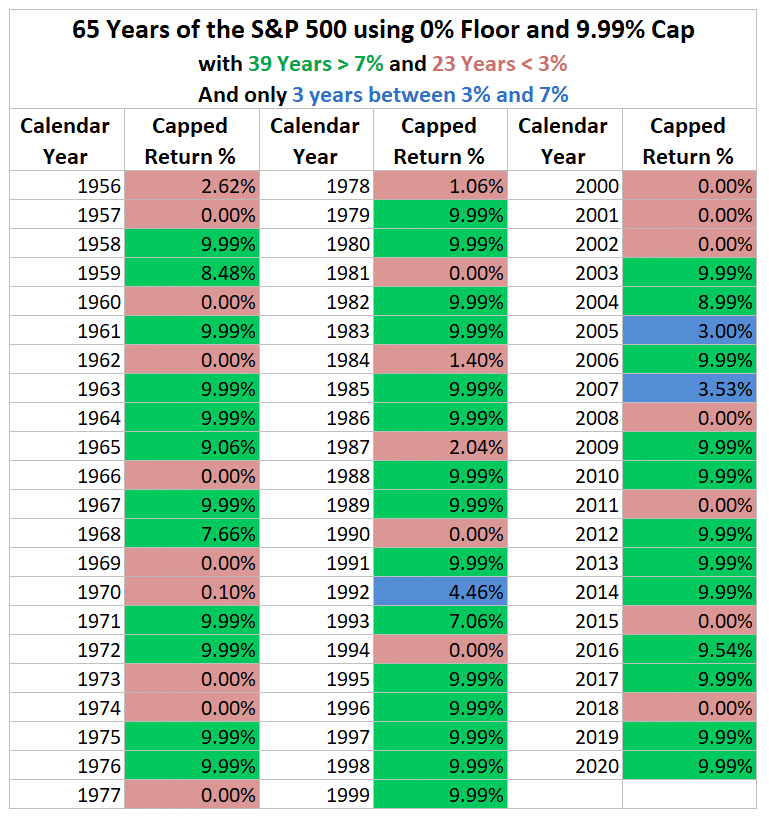

Consumers would now only see IUL as a smooth ride. Let’s compare this flaw of averages with the last 65 years of the S&P 500 using a 0% floor and a 9.99% cap:

Notice that 62 out of 65 years produced crediting below 3% or above 7%, and only 3 of 65 years experienced crediting in between. Yet most consumers will only see illustrations with steady crediting between 3%-7% every single year setting false expectations!

Back to our history lesson…

Like the arms race, insurance companies began retooling their illustrations to position themselves competitively with the new regulations.

However, AG49 also mandated that carriers must substantiate the affordability of their hedging strategy. To account for options pricing, a company’s maximum crediting rate could be no more than 145% of their general account’s earnings.

The forlorn monster pleaded with its maker for a mate, and the creator conceded.

One company (who ironically isn’t even a major IUL player) posed a question: What if the policyowner participated in cost sharing for the hedging? If a specific fee was charged shouldn’t this also be budgeted into the carrier’s allowable options budget?

Surprisingly, regulators agreed.

The monster’s mate began being assembled.

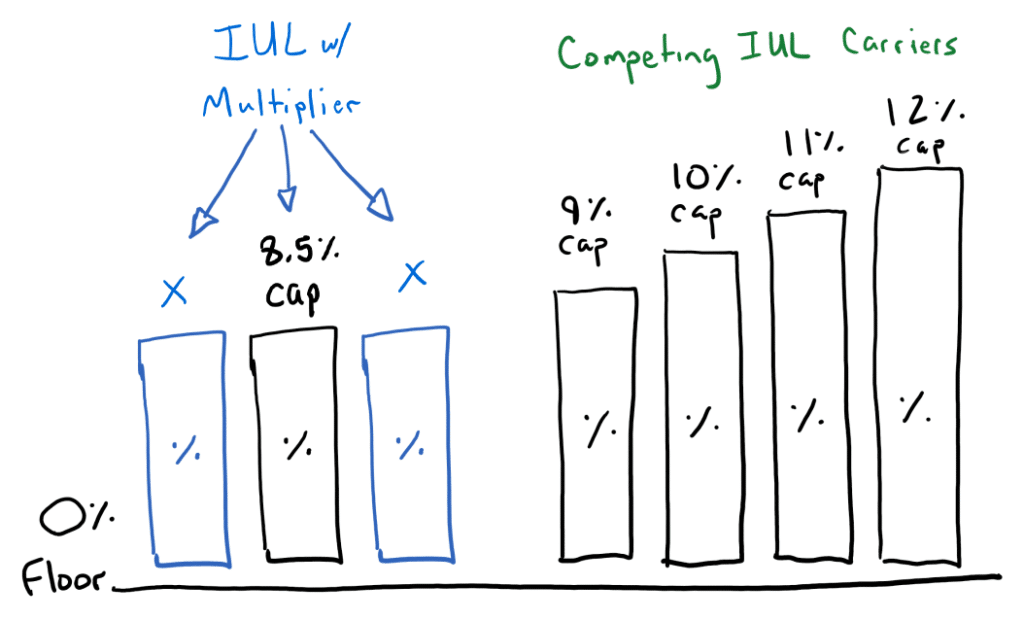

Another Indexed Universal Life Insurance company took this idea and literally turned the tables. Instead of competing vertically going for the highest cap, they created a new IUL category by competing horizontally. Rather than charge a nominal fee to elevate their cap, they essentially tripled their charges to buy multiple options silos within a single IUL policy.

Their illustrations only displayed an AG49 rate of 5% or 6%, but the actual growth rate illustrated in the high teens. This concept was a smashing success, other carriers followed suit, and these products captured massive market share.

The industry again cried foul! They claimed unsuspecting consumers would have no idea what was going on under the hood, especially the copious fees that may cannibalize their policy after a string of bad years.

Another task force decided the fate of multipliers and on December 14th, 2020 AG49-A became the new standard.

Horrified by the consequences of his latest work, the creator abruptly destroys the monster’s new mate.

The new mandate is simple. Illustrations are prohibited from showing any positive effect from buy-up caps or multipliers beyond the maximum AG49 rate even though multiplier fees would still be illustrated. If an illustration uses a rate lower than the maximum, then perhaps some amount of the multiplier can make its way into the illustration, but it’s all formulaic and difficult to discern if and how much.

This is uniformity?

Consumers now have access to features that deduct from their cash value, yet no proper cost/benefit analysis can be performed.

What about consumer understanding?

Field agents must resort to storytelling rather than financial modeling. Rogue spreadsheets are now regularly being cobbled together (some more accurate than others).

Shouldn’t these be compliantly displayed on carrier paper like they were in the past?

Aren’t historical lookbacks the only way to facilitate “consumer understanding” of IUL’s inevitable volatility (whether multiplied or not)?

Couldn’t the uniformity we’ve been promised simply be a predetermined collection of historical slices (including the lowest period and another matching the AG49 rate)?

Wouldn’t historicals run at the mid-point between an IUL’s current parameters and its guaranteed minimum parameters better represent what happens if caps and participation rates continue waning?

Of course! However, because of how AG49 semantically overlays with Universal Life’s original Model Regulation #586 from 1995. these incredibly useful tools are forbidden. Isn’t it time the creator brought the monster back to the lab and started anew?

Where is the monster wandering to now?

The latest trend in Indexed Universal Life is all about volatility-controlled strategies by third-party managers. Since their algorithms shift from equity exposure to bond exposure when volatility is high, the cost to hedge these strategies is significantly cheaper. Therefore, IUL companies offering these strategies use the cost savings to bake some sort of bonus into the illustration and/or offer participation rates exceeding 100%.

Although it’s not a forbidden multiplier for a fee, isn’t this simply a photo negative? You’re offering a cheaper hedge so you can multiply/enhance actual performance.

Given that bond yields are at historical lows, will the affordability of this hedge endure? Since these volatility-controlled models don’t have extensive histories, AG49-A actually allows the use of a “hypothetical benchmark index” for their illustration rate even if said hypothetical benchmark isn’t actually even offered within their IUL.

Wait, what?!?

The creator must continue chasing the monster as he roams through uncharted territory.

Listen, I’m all about free markets. Quite frankly the consumer should have access to all of these diverse crediting strategies whether it be volatility-control, tracking traditional indexes, or even multiplying any of the above so long as the additional costs and implications can be properly modeled to facilitate an informed decision by the consumer.

Disclosure rather than prohibition is the key. Let the client decide what kind of crediting methods are most appropriate for themselves by demonstrating the variability involved in each. By creating uniform standards for compliant historical backtests we can appropriately model any type of strategy and better frame more realistic expectations for consumers.

Only then will we stop reactively stitching up this monster.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com