The Simple Science Behind The Banking Concept

How Borrowing Against Life Insurance Beats Paying Cash For Everything

Once you’ve finished the video above…

Transcript below for “The Simple Science Behind The Banking Concept”

The Top 4 Myths Behind Becoming Your Own Banker (Article)

See How Banks Invest And How You Can Reap Similar Benefits (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

Banks profit exponentially off almost everyone in America.

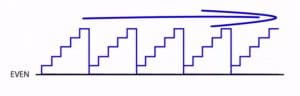

Either they’re lending you money to buy cars, real estate, business inventory or equipment:

The Top 4 Myths Behind Becoming Your Own Banker (Article)

See How Banks Invest And How You Can Reap Similar Benefits (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

Or you’re parking your cash safely inside their holding tanks so that hopefully you won’t ever need any of their loans. Meanwhile, they’re loaning out every single dollar of your savings multiple different times for a handsome profit while they give you peanuts for the use of your capital:

Either way, they win.

This video will show you how to profitably run those exact same cash flows through your own private banking unit to build two assets at once and to get your money wearing multiple hats. Now in order to explain how to do this for yourself, we’re going to dissect both of the ways that banks profit using the example of a real estate investor.

Keep in mind though that this exact same model can be used by business owners investing in their business or by fiscally responsible consumers with their major purchases in life.

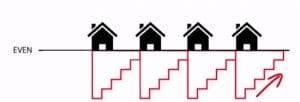

Let’s first look at traditional bank financing for ongoing real estate investments. You essentially borrow against the property itself to qualify for the bulk of the capital necessary to acquire it.

You then must make ongoing structure principal and interest payments to pay off that loan and get yourself back to even. Eventually though, you’ll want to invest in yet another property, so you again have to prove not only your own credit-worthiness, but also the feasibility of the project you want the money for. So long as you continue to be steady and diligent about paying back the bank according to their terms, you should be able to hopefully continue financing your real estate empire.

But be very clear about the fact that there is no guarantee that banks will continue to make this liquidity available to you. If it’s a soft economy, or if for whatever reason the bank doesn’t share the same vision for your project, they can just pull the plug on your financing.

This is all the more reason to save up your own cash, so you don’t need to rely on bank loans. Let’s face it. Some people simply hate the concept of borrowing, even if it helps them exponentially acquire more assets. They would just feel better paying cash for every single property they buy and not being on the hook to anyone.

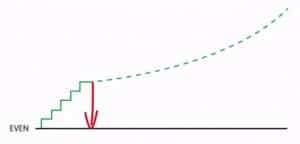

Well in order to do so, you first have to save up enough capital in a bank account that earns very little or no interest.

Then once you acquire that first property, you own it free and clear, and you don’t owe anybody anything.

Even though you don’t need to pay any debt service to banks for the use of their money, if you want to buy a property in the future, you still have to continue making ongoing payments into one of their accounts earning very little or no interest. That way you will have enough cash in the future to purchase that next property free and clear.

Because of this, the payment structure you have is nearly identical whether you pay cash outright for every single property or you finance them 100% using bank loans.

Now some of you may be saying, “Wait, when I pay with my own cash, at least I don’t need to pay interest for the use of the bank’s money.”

True, but remember that you are passing up earning a reasonable interest rate on your own capital by keeping it safe and accessible inside their coffers. In fact, you’re voluntarily not gaining any ground whatsoever on this very large block of liquid assets in between every single property purchase.

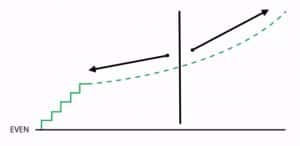

Even if interest rates go up considerably in the future, you wouldn’t be able to take full advantage of it because as soon as you get your account to the point of critical mass, you kill your compound curve every time you withdraw that cash to buy another property.

And it doesn’t need to be that way.

For the rest of this video, I’m going to show you how to create a money multiplier effect with your own bank by keeping your liquid reserves safely and continuously compounding for you, even though you have them doing double duty elsewhere.

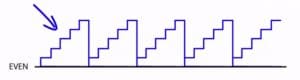

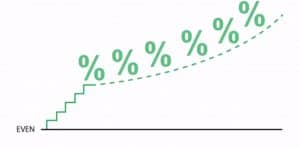

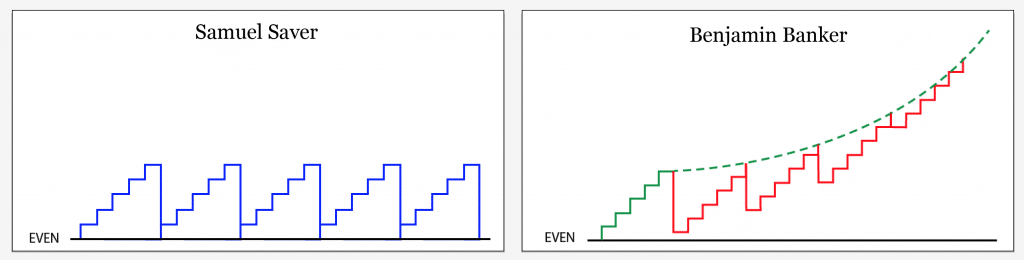

You see, in a perfect world, you’d save up assets one time and they’d go ahead and compound into the future. What’s so powerful about compounding is you not only earn interest on your principal, but pretty soon you earn interest on the interest through principals already earned. It creates this wonderful snowballing effect.

That’s why the curve on the right is a lot steeper than on the left. In fact when I ask clients, “Which side of this curve would you rather have?” Everybody wants the steeper side on the right, but you don’t get that without putting in your time on the early part of the curve. You see, it’s just time value of money. Keeping assets continually compounding over time is the key.

Unfortunately though, these purchases do need to be made. Every time they are, it just resets our compound curve to the very beginning, killing our chances of ever getting to the far right-hand side of that curve.

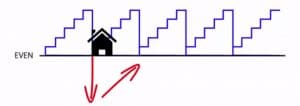

That is unless there is a way to contractually borrow against our assets at any time for any reason. You can see when we do, that red line comes down, indicating there’s a lean against our asset base, but notice that the entire asset base continues to compound up that green curve. As we pay down the lean against the assets, we actually end up at a higher place in line each and every time.

That’s really the biggest component of this strategy. The fact that your entire asset base continues to compound in your favor in spite of having used some of it to make those purchases.

Now it helps too that the asset class we’ve chosen also happens to grow each and every year at a very favorable rate of return: a return that does not start with a dot. It’s also immune to market losses and immune from taxes as well. All these things work in its favor.

Now keep in mind that the cash flow and payment structure we’re using is an apples to apples comparison with somebody paying cash. The fact that you don’t have your entire asset base compounding for you when you withdraw cash from an account to make a purchase, you’d need such an astronomical rate of return to make this work and to overcome any taxes due that it simply just pales in comparison to how effective the banking strategy can be.

Click here to schedule a call to discuss your unique situation with one of our team members so you can have all your questions answered and start the architecture of your own private bank.

Or, learn about the best dividend-paying whole life insurance policy to become your own banker.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com

The Top 4 Myths Behind Becoming Your Own Banker (Article)

See How Banks Invest And How You Can Reap Similar Benefits (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

The Top 4 Myths Behind Becoming Your Own Banker (Article)

See How Banks Invest And How You Can Reap Similar Benefits (Video)

4 Ways Whole Life Insurance Can Help Your Retirement (Article)

Whole Life’s Riders And Growth Components Explained (Video)

Detailed Banking Case Study Using Whole Life (Video)

Best Whole Life Insurance Policy for Banking & Why (Article)

Buy-Sell Agreements Using Life Insurance Explained