How To Start Your 4-D Banking System

Overview for starting your own 4-D Banking system by repurposing existing assets for maximum liquidity, applying for new accounts & loan options, and rerouting future cash flows to maximize control.

In this video, Hutch explains how a typical “two-dimensional” financial setup—relying solely on high-yield savings accounts and retirement plans—limits liquidity and tax efficiency, creating missed opportunities and hidden costs. He introduces the 4D Banking model, which integrates whole life and indexed universal life insurance to maximize liquidity, growth potential, and tax advantages, while providing backstops across multiple assets. This approach allows for more strategic use of funds through compounding and leveraging, reducing the inefficiencies of traditional single-use assets.

At Banking Truths, we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

Overview for starting your own 4-D Banking system by repurposing existing assets for maximum liquidity, applying for new accounts & loan options, and rerouting future cash flows to maximize control.

Hutch discusses the contrarian philosophy of 4-D Banking. Included is a 5-minute intro video discussing the 4-Ds, a 30-minute podcast on the psychology of leverage, and the original hour-long 4-D Banking webinar.

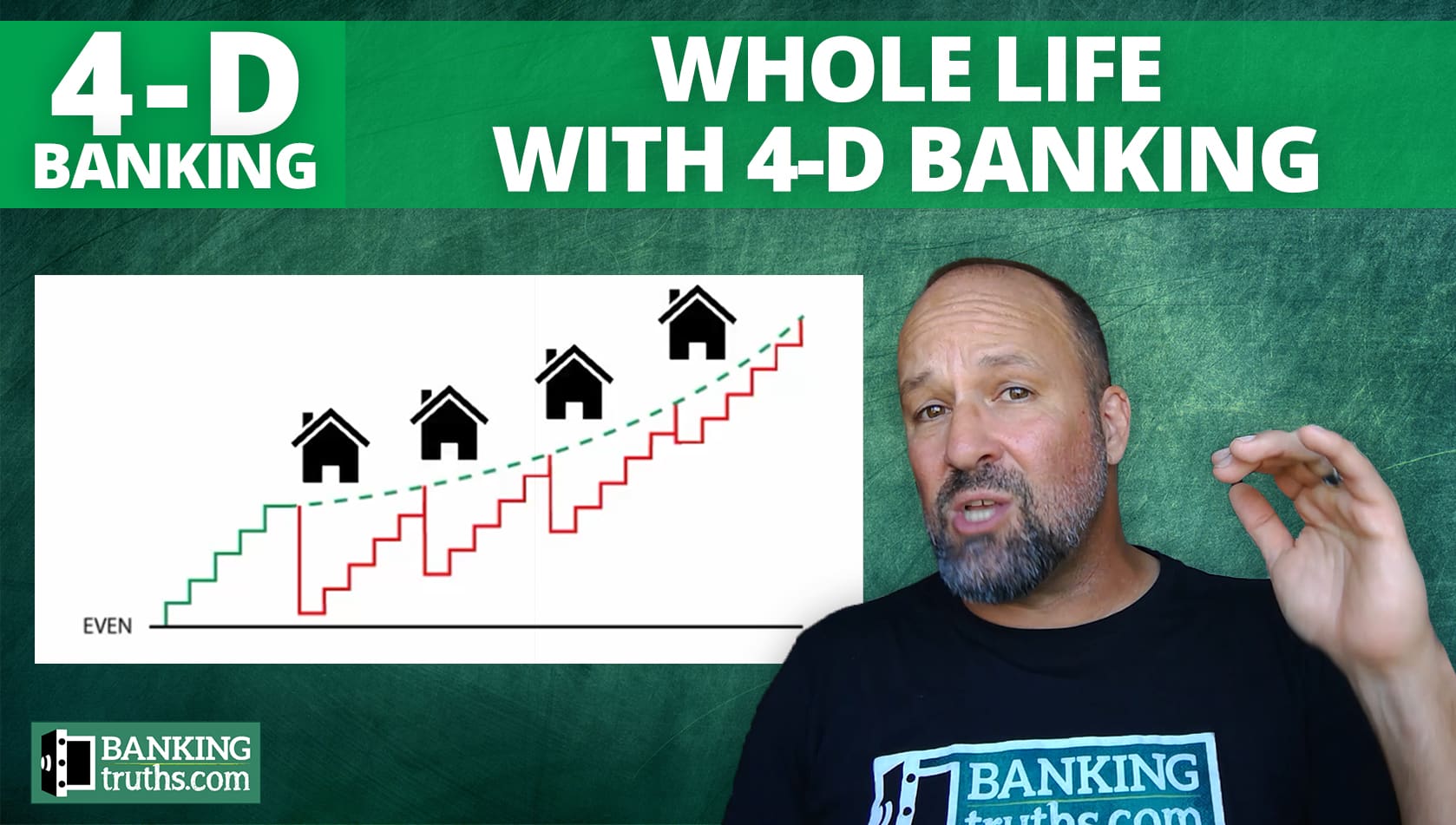

Learn how Whole Life works and see how Whole life and/or IUL can substantially enhance the overall performance and utility of an emergency/opportunity fund within the context of the 4-D Banking system.

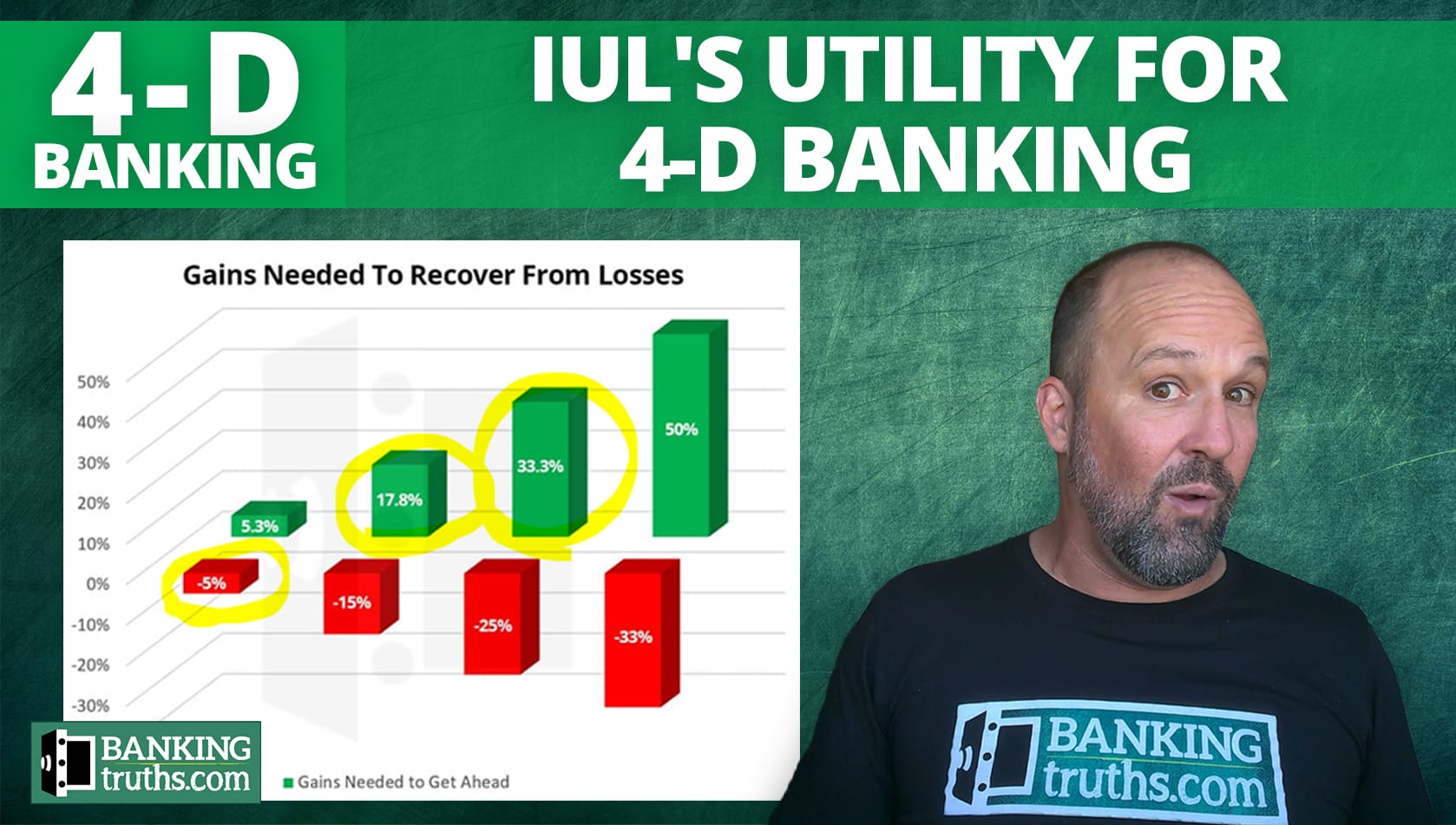

Hutch discusses how Indexed Universal Life can provide unique value in a 4-D Banking system by offering locked loan rates in the 5%-6% as well as the opportunity for positive arbitrage without market risk.

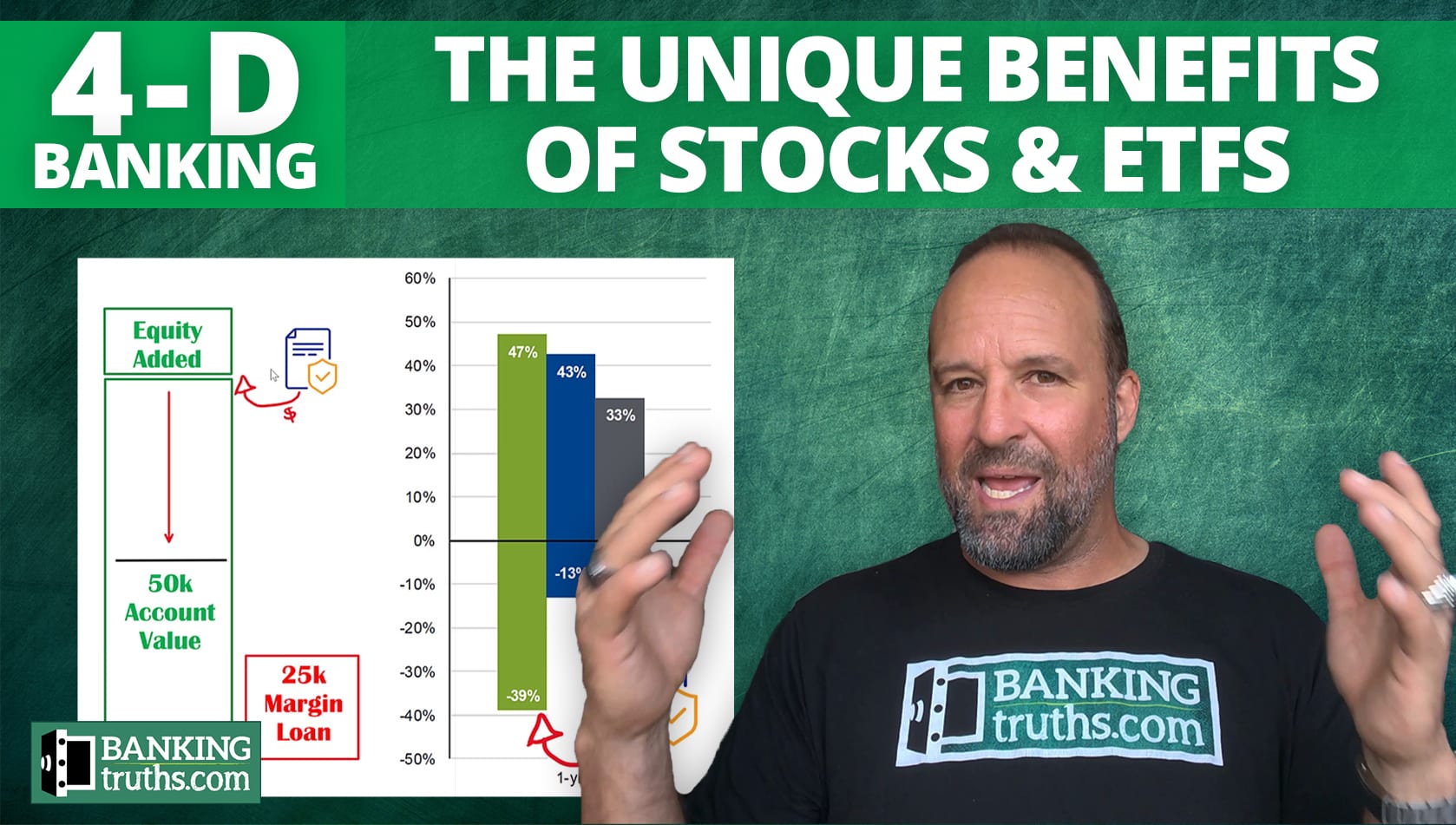

Listen to how a well-diversified brokerage account can be the key to the cheapest and most tax-efficient loans. Learn how to quantify and confidently manage risk with the other components of 4-D Banking.

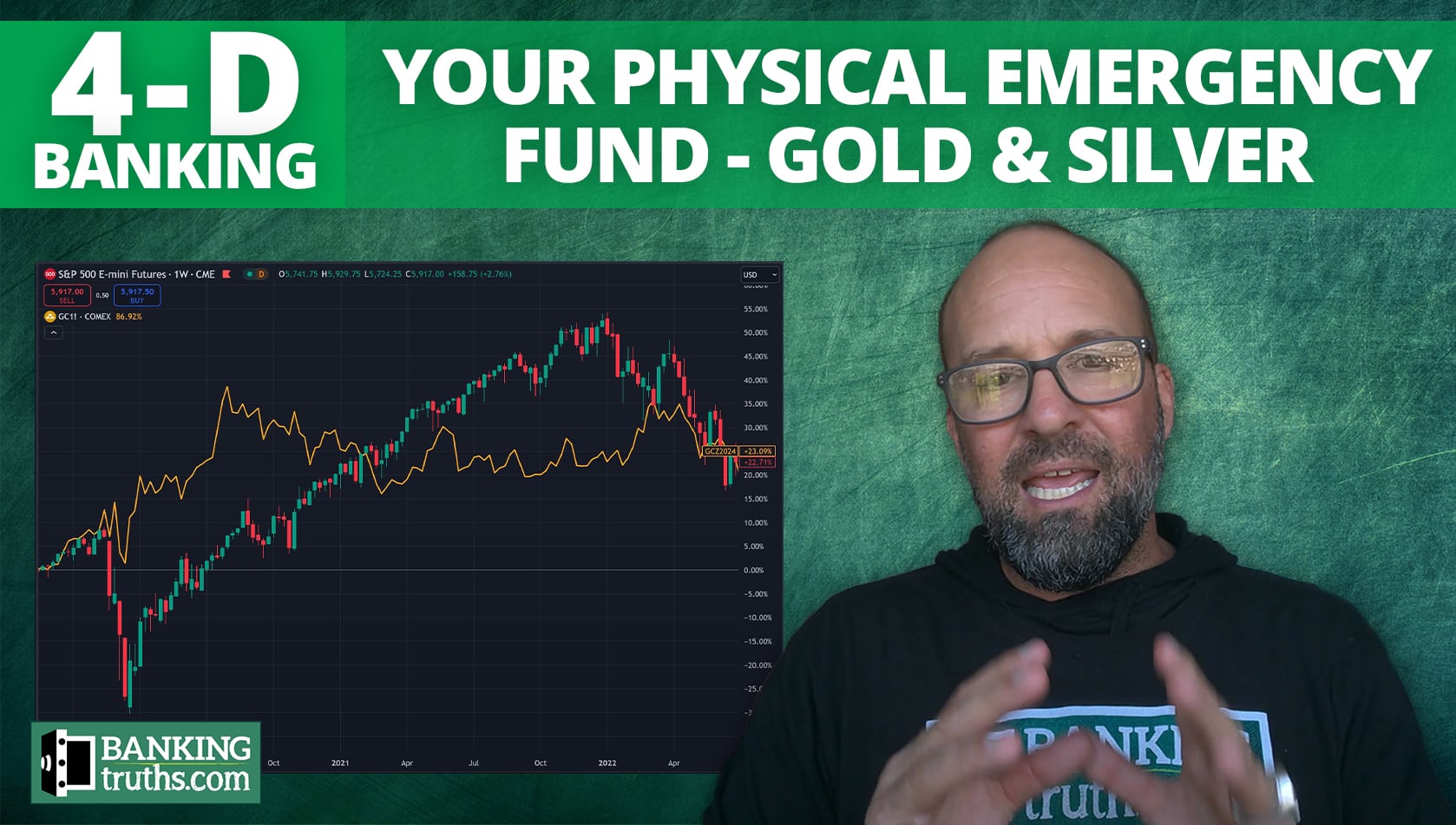

Hear Hutch discuss the case for gold & silver and their place as part of a comprehensive 4-D Banking plan. These hard assets can give you the best liquidity gain for the buck when you need it the most.