How To Start Your 4-D Banking System

Overview for starting your own 4-D Banking system by repurposing existing assets for maximum liquidity, applying for new accounts & loan options, and rerouting future cash flows to maximize control.

Hutch from BankingTruths.com introduces 4-D Banking, a strategy that goes beyond traditional life insurance, leveraging assets like retirement plans, stocks, real estate, and precious metals to maximize compound interest and tax efficiency. By coordinating these assets, 4D Banking enables tax-free borrowing and mitigates risk while enhancing liquidity, allowing assets to continue compounding even when used. This approach emphasizes the “four dimensions”—tax exposure, growth potential, risk/volatility, and the “triple L’s” (liquidity, leverage, and loan rate)—to create a balanced, flexible financial strategy for building wealth over time.

At Banking Truths, we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

In this episode of “Road Noise with Hutch,” Hutch critiques the “debt-free dream” mindset, contrasting it with the wealth-building potential of Infinite Banking (IBC) and Economic Value Add (EVA). He explains his “4D Banking” system, combining ideas from Velocity Banking, IBC, and EVA to maximize cash flow, compound growth, and liquidity—enabling people to build wealth independently of traditional banks.

0:00 – The common psychology of debt vs. a privatized banking mentality

1:30 – The flaw within every “debt-free-dream” including Velocity Banking

3:00 – Cash is trash (and actually backed by a lot of debt)

6:30 – How even blue chip stocks & index funds are backed by debt & leverage

8:50 – Using strategic leverage & managing cash flows to build wealth

10:30 – Choosing assets & debt tools that can’t be revoked from you

12:10 – Nelson Nash’s take on “You finance everything you buy”

13:30 – EVA – the corporate finance mindset to be applied to personal finance

16:00 – Why a Whole Life policy is the perfect measure for a “risk-free rate of return”

18:00 – Why diversifying a stock portfolio doesn’t work anymore

20:30 – 4D Banking’s 4 major asset classes

22:00 – Using 401k loans as a liquidity backstop

23:00 – The problems with a Roth

23:30 – Precious metals the ultimate liquidity backstop

25:00 – A stock or ETF portfolio as the borrower’s first stop with deductible interest

26:30 – Life insurance cash value as your first line of defense

27:00 – HELOC as a way to unlock additional liquidity

28:30 – “You Finance Everything You Buy – Even if you Pay Cash”

Overview for starting your own 4-D Banking system by repurposing existing assets for maximum liquidity, applying for new accounts & loan options, and rerouting future cash flows to maximize control.

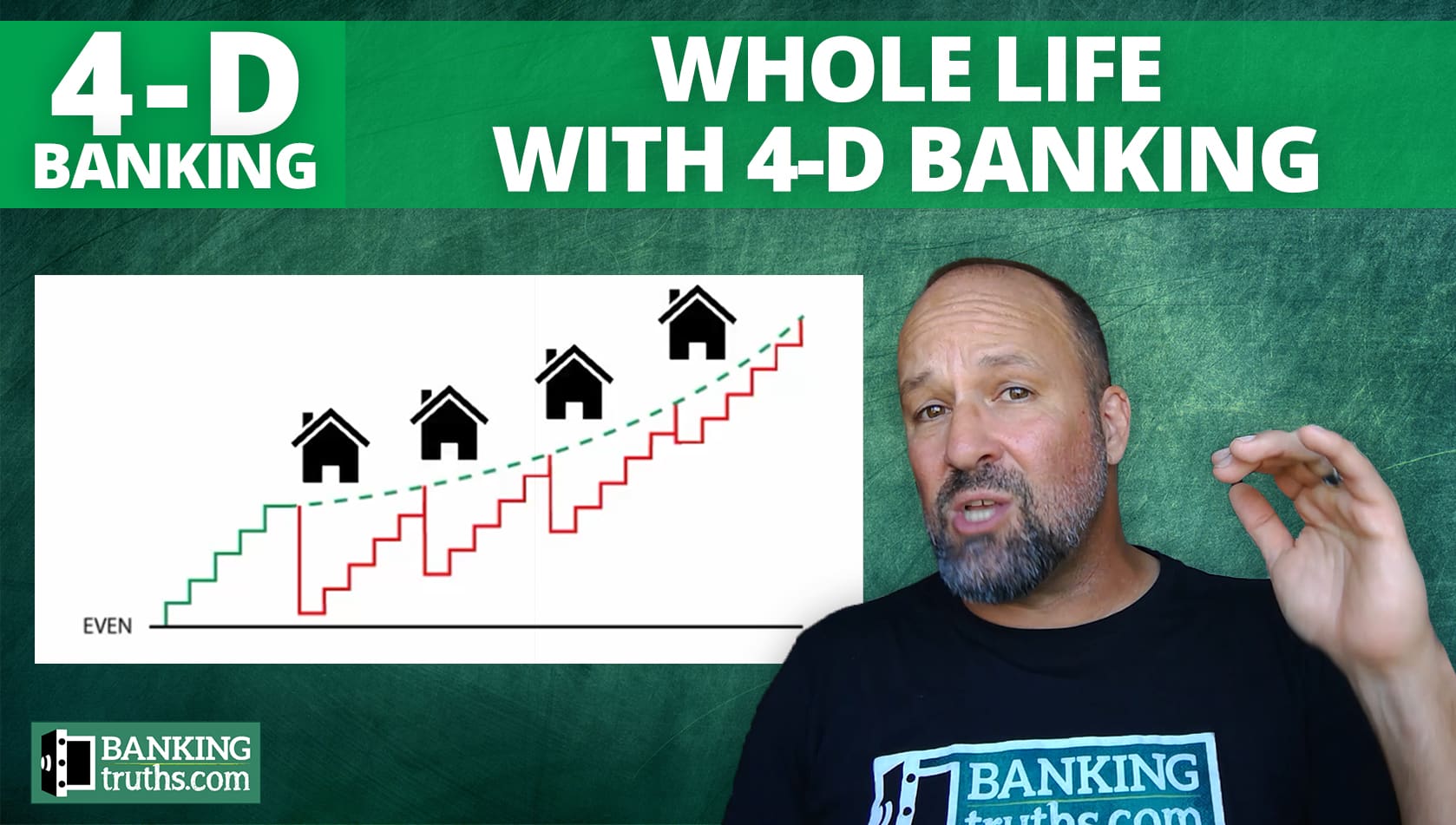

Learn how Whole Life works and see how Whole life and/or IUL can substantially enhance the overall performance and utility of an emergency/opportunity fund within the context of the 4-D Banking system.

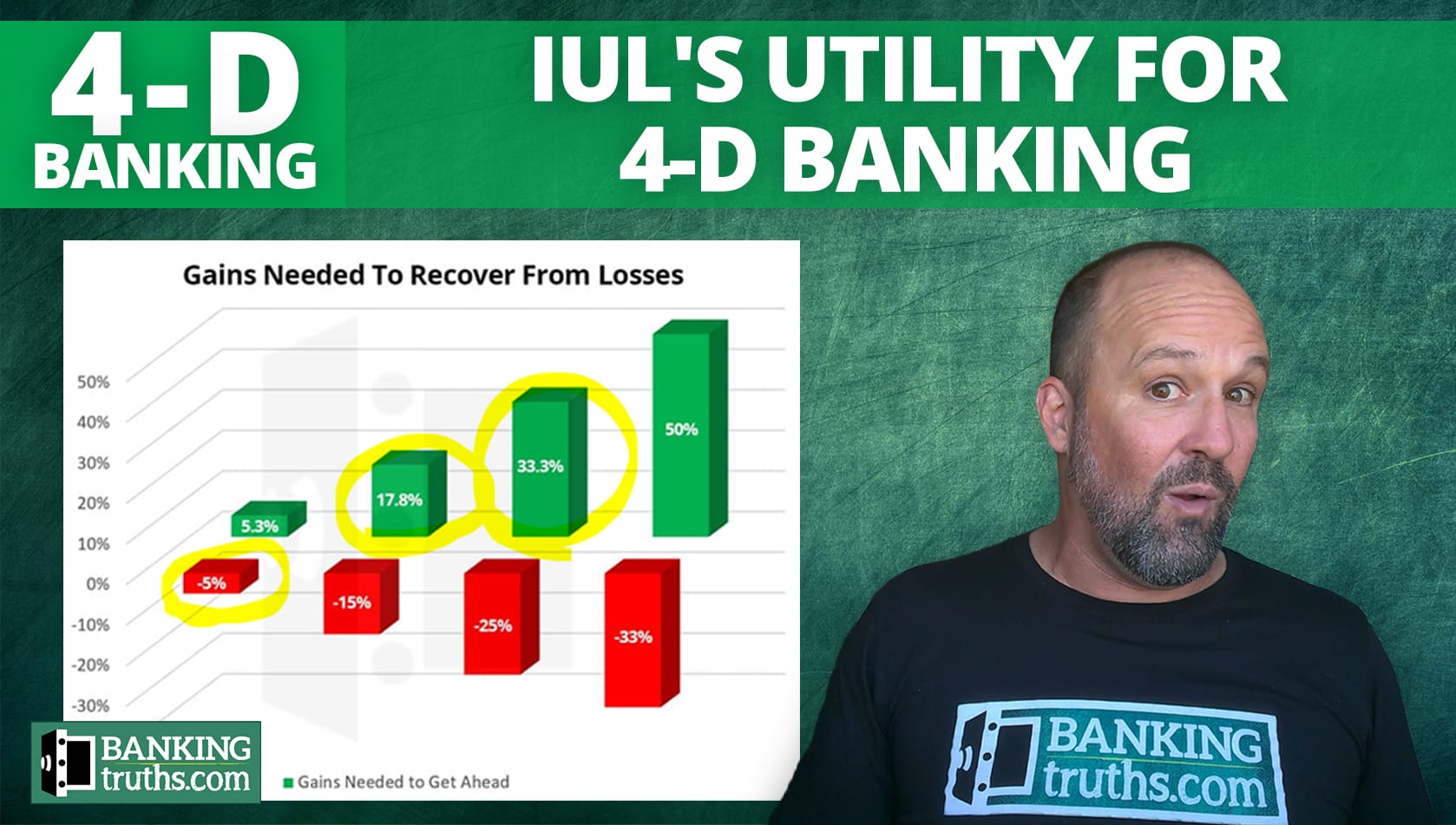

Hutch discusses how Indexed Universal Life can provide unique value in a 4-D Banking system by offering locked loan rates in the 5%-6% as well as the opportunity for positive arbitrage without market risk.

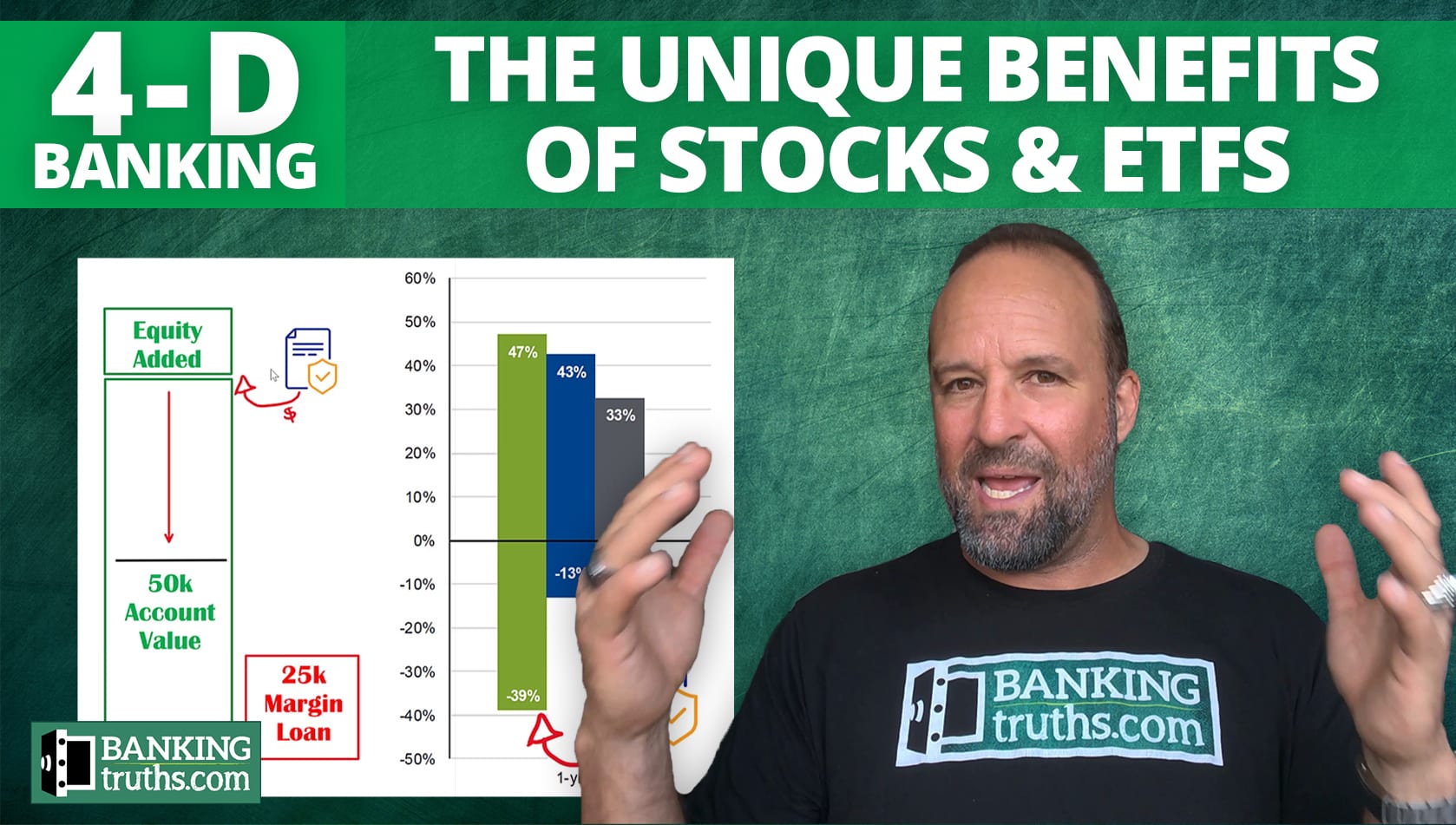

Listen to how a well-diversified brokerage account can be the key to the cheapest and most tax-efficient loans. Learn how to quantify and confidently manage risk with the other components of 4-D Banking.

Hear Hutch discuss how to re-characterize retirement plan assets as well as how to unlock $50k-$100k of liquidity that can never be taken away as your emergency governmental bailout plan.

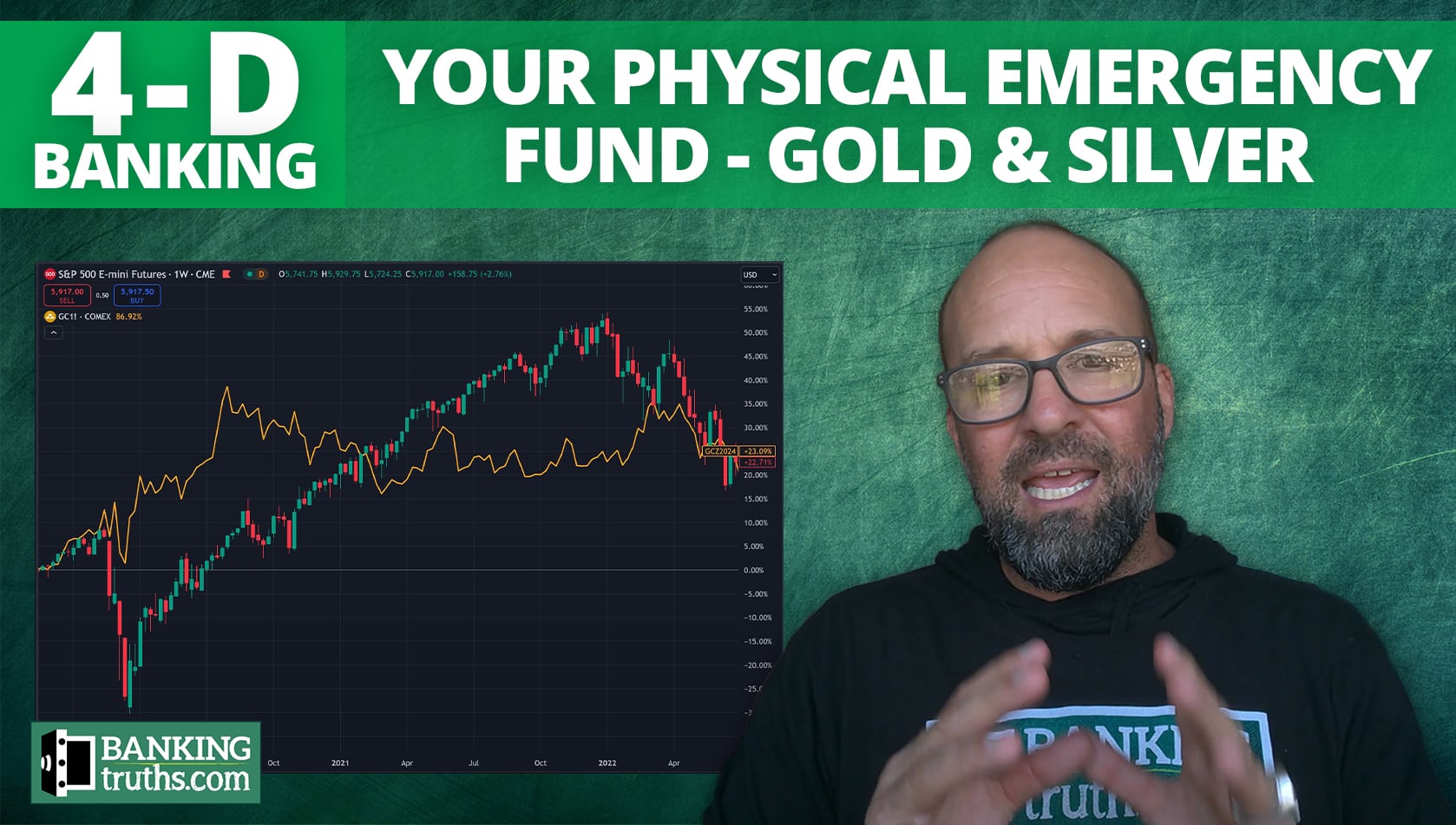

Hear Hutch discuss the case for gold & silver and their place as part of a comprehensive 4-D Banking plan. These hard assets can give you the best liquidity gain for the buck when you need it the most.