Get Custom Fitted For

Buy-Sell Life Insurance

Simultaneously hedge against your partner's premature death or disability for pennies on the dollar

WHAT SHOULD I EXPECT FROM THE CALL?

We get you up to speed by filling in any learning gaps & answering questions you have.

We better understand your ownership structure, so we can educate you about your ideal product options.

We run quotes on each owner from the top insurance companies and educate you about the various product options

We discuss various ways to own and pay for the new buy-sell life insurance policies balancing simplicity and tax-efficiency

You help us refine things further as you learn more & become confident in how you will ultimately structure your buy-sell.

No pressure, just answers & options

For the last 17 years our team has been helping entrepreneurs like you favorably incorporate life insurance to enhance their business efforts.

Here's what WON'T happen on our call together...

No Hard-Pitch

No Bait & Switch

No Frothy Fluff

No Holding Back Info

No Lackluster Products

No Pressure, Ever!

Let us do the "Shopping & Modeling" for you

We're all independent brokers & contracted with multiple carriers.

So we're constantly stress-testing which life insurance policies/companies will give you the best fit for your particular situation.

Our clients are really smart people like you!

Our goal is to educate you about all your options,

and then let you sell yourself.

WHAT OTHERS ARE SAYING

SCHEDULE YOUR CALL TODAY!

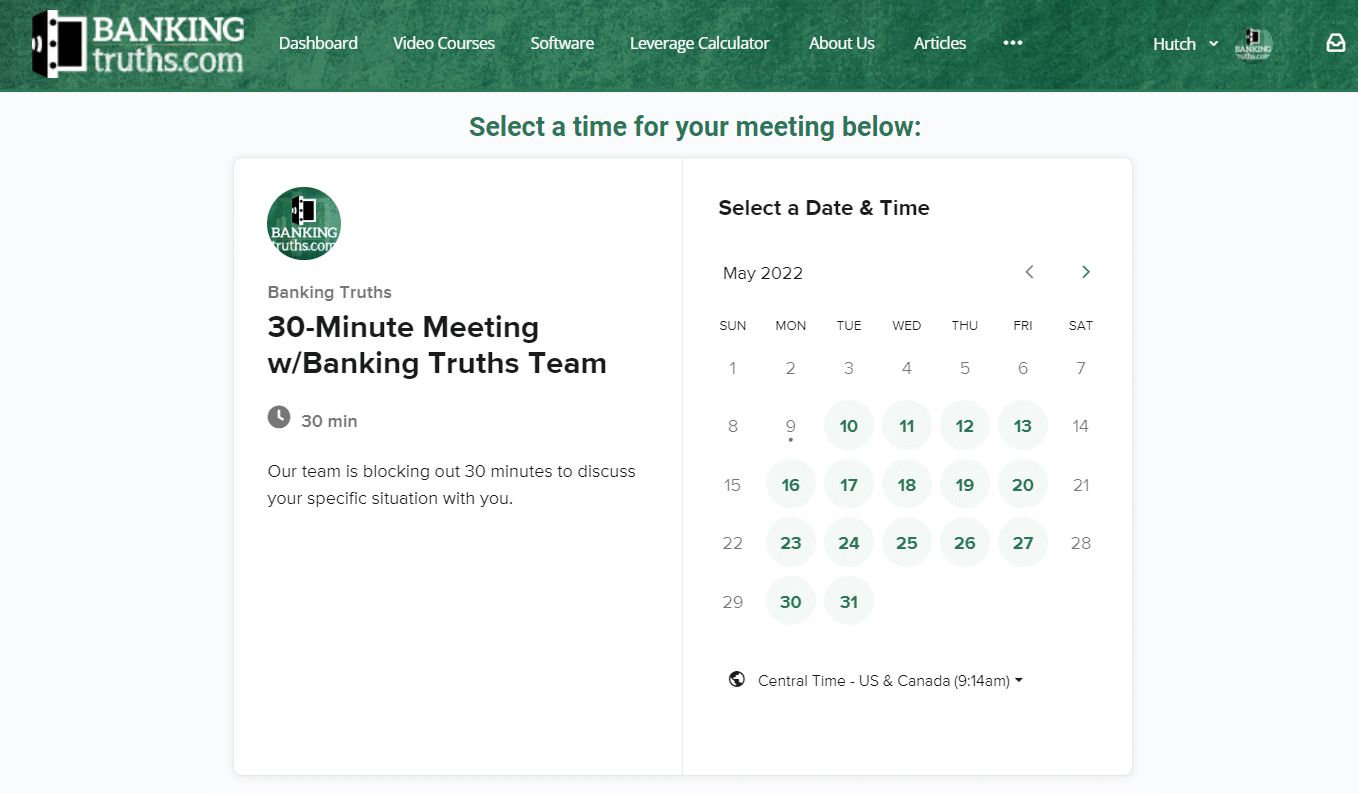

STEP 1

Complete the form so we can share accurate & timely info with you. (Rest assured we are not interested in spamming anyone. You can easily opt-out of any genre of communication whenever!)

STEP 2

Pick a 30-minute slot on our team’s calendar.

STEP 3

Jump into a zoom call with our team, where we answer any questions you have and discuss different options to model out for you.

WHAT ARE YOU WAITING FOR?

WHAT OTHERS ARE SAYING

FAQs About This Process

We design all policies with a min-max premium range, where the minimum premium due is only around 20%-30% of the maximum allowable amount.

Since most people start with at least one maximum-funded premium this gives you some flexibility to skip multiple future minimum premiums if absolutely necessary.

If immediate flexibility is needed, then certain insurance companies are more forgiving than others, and we can focus on those first.

Probably not, but if you are over 66 or have very serious unresolved health issues, we may have to use your spouse or kids.

That said, we’ve found that people tend disqualify themselves prematurely, when in fact we have often been able to work magic by shopping to multiple carriers and properly framing the facts.

We’re all about shrink-wrapping the least amount of death benefit allowed around whatever maximum premium you plan on pumping in.

It’s well-documented public knowledge that major banks, fortune 500 companies, and well-known college football coaches think using life insurance is a great investment.

We specialize in taking this big institutional thinking and bringing it down to real estate investors, business owners, and fiscally responsible savers so they can receive the exact same benefits.

We do NOT charge an up-front fee for our initial meeting to help you with your understanding of this strategy and related products. Throughout this initial call, we are both mutually exploring if it would be a good fit for us to proceed further together.

Assuming we both decide to explore a professional relationship further, we will also NOT charge for any follow-up meetings.

We only get paid if you have us write some sort of life insurance policy on yourself, a family member, or key employee. As independent agents, we are unattached as to which company or policy type you ultimately choose and are happy to educate you about your options and model them out for your particular situation.

Well it depends on how complicated your health situation is, and which insurance company you like best.

If you are in relatively clean health (perhaps just some controlled complications), underwriting can take as little as a week and sometimes even without a health exam.

If the insurance company has to do some digging into your health situation (looking into old doctor records and requesting an exam) could push the timeframe to 1-2.5 months.

“anonymously shop” your fact-pattern to various carriers to see who plans to play nice with you.

Several things actually.

Most of our competitors have some kind of longer-term “sweetheart contract” with certain insurance companies. This incentivizes them to concentrate their business with said carrier to increase their commission payout in some way, shape, or form (often to your detriment)

We went fully independent in 2012 after having worked directly under 2 major insurance companies. We decided it was best for the clients we serve to only maintain base broker contracts with any and all carriers. Having no minimum quotas gives us the flexibility to stay nimble, move with the market, and always offer the best of breed companies & products to our clients. That way we can match you with the most appropriate offering.

What else?

Some of our competitors run bigger organizations, but we’ve had clients come over reporting how they felt like they were part of a large mill. On the other end of the spectrum is the myriad of lone-wolf agents offering loads of personal attention while selling insurance out of the back of their car, and then not properly servicing them once the honeymoon is over.

We like to think of ourselves as right down the middle with a lean & mean organization with every specialty covered to be able to offer expanded advice when appropriate (broader education in terms financial, retirement, investment, taxation, estate, etc.).

For that reason, we don’t take on every client so we can retain the capacity to best serve those we do choose to take on.

We’d be happy to have an initial conversation to see if on paper there’s a mutually beneficial fit to move forward together.

Well, there is no catch. But of course I’m going to say that, right?

Let me elaborate…

If you work with an agent or group that designs your policy properly, then you’re really just repositioning your liquidity. That’s it. You’re taking liquid assets from an inefficient holding tank (a bank or mattress paying little to nothing) and shifting that liquidity over time to one of the oldest, strongest, and/or biggest mutual life insurance companies in existence.

Why? So you can get better growth, shelter from taxation, and pick up some additional protection benefits as result. Plus, you liquidity keeps compounding even while you’re using it.

Is there a cost? Short term: yes – there are upfront costs and the first couple of years are the worst years. Long term: not as much – since a properly designed policy would end up with considerably more net spendable dollars than if you had not done the policy at all.

It’s really as simple as that, and that is what we at BankingTruths.com intend to model for you in an educational non-salesy manner. Then you can decide if and how much you want to direct towards this type of private banking strategy.

There’s no catch. We offer to do this modeling for free because we’ve done this enough times to know that most of you will follow through with some sort of policy initially only to get more policies in the future on family members.

We’re ready when you are. Just remember you’re not getting any younger. So when’s the best time to plant an oak tree? 20 years ago. When’s the next best time?

Now!

So, book your call and we’ll prove it to you.