The 10/90 Myth Inside Life Insurance Policy Design

Let’s unpack this “10/90” myth including:

- What it is

- How it started

- Why it doesn’t really matter

- What matters far more w/ Whole Life

- How a 10/90 design can be counterproductive

I knock out these bullets in order below:

What does 10/90 even mean?

10/90 refers to the ratio of Whole Life’s base policy premium to the amount of Paid-Up Additions (PUAs) you can pay into a given policy in a particular year.

On the surface, this seems like an amazing ideal that should be strived for.

🐃 However, just like trying to compare one Whole Life company’s dividend rate to another’s, this BULLSHIT Base-to-PUA ratio is an apples-to-oranges comparison.

However, people naturally want to simplify the complex subject of Whole Life design for Infinite Banking. They therefore are often happy latch onto simplified metrics to put their minds at ease.

Just like the “check engine” dummy light, there’s so much more going on under the hood of a 10/90 or a 20/80 or whatever, so don’t miss out on getting a better-performing policy without fully exploring the mechanics.

At Banking Truths we believe in providing education & modeling so you can decide if this strategy is a good fit for you:

- Get all your questions answered

- See the top policies modeled out

- Never any pressure or hard pitches

How Did The 10/90 Strategy Start?

Go figure, a group of IBC agents thought up this “must-have” ratio for IBC Whole Life policies to simplify their sales tactics.

These agents had something called an FTA Contract with Guardian Life, which stands for “Full Time Agent.”

And of the old “True Mutual” Whole Life companies, guess the only company that allows you to pay as little as 10% base premium and 90% in PUAs?

You guessed it…Guardian Life…how convenient.

Now to be clear, I have ZERO beef with Guardian!

In fact, I’m a policyowner with 2 of my oldest family policies, and still am appointed with Guardian as a standard broker to sell their products…WHEN IT’S THE RIGHT FIT FOR CLIENTS.

Also, from 2008-2012, before I went independent, I actually had a Guardian “Career Contract” (with quotas & incentives). Upon leaving in 2012, I was offered this type of FTA contract, which has greater financial incentives than the standard broker contract.

I declined to take the FTA and instead chose the broker contract to maintain my independence, and keep my business model clear of any quotas or long-term incentives that would have me leaning away from the best recommendation for clients.

Had I taken the “Full-Time Agent” contract (FTA), then the 10/90 story would be a genius way to create some kind of false standard for IBC and sell more of the policies that butter my bread (whether it was a good fit for clients or not).

Why the 10/90 Base-to-PUA Ratio Doesn't Matter

Quality > Quantity … full stop !!!

You know this is true with everything else in life, so why would it be any different with Whole Life insurance?

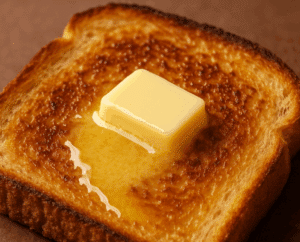

🍖 Just like with a quality meal, the quality of ingredients matters way more than the quantity of their proportions.

Yes, adding term riders to boost the amount of PUAs you can put onto a Whole Life policy designed for IBC is favorable and a standard design practice.

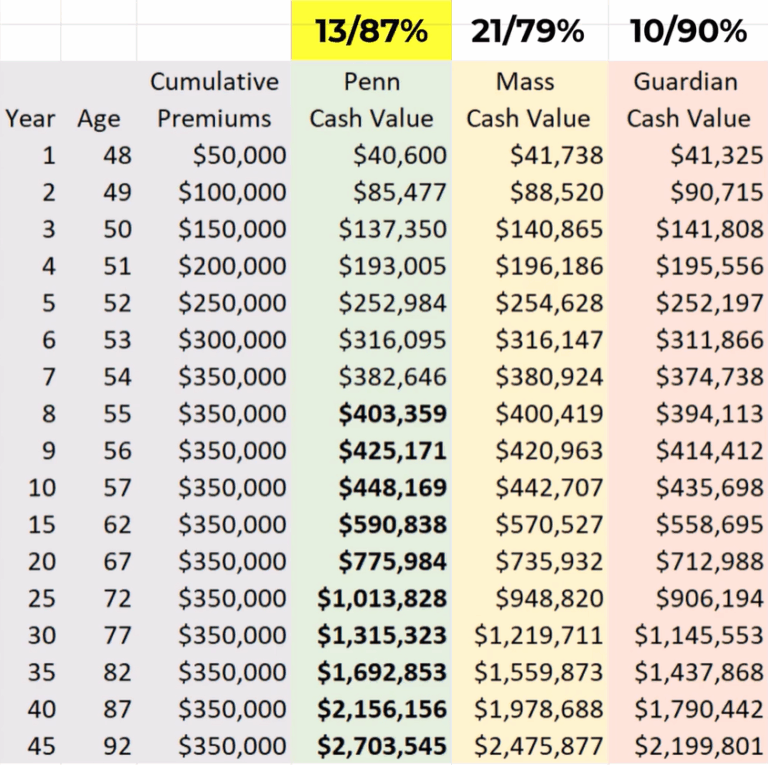

👀 But look at how both Mass Mutual and Penn Mutual handily outperform the Guardian 10/90 with their respective minimum Base-to-PUA ratios for this 48-year-old male 👇

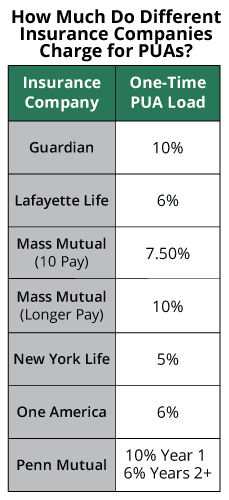

“PUA Loads” (a different policy metric that’s seldom discussed) is part of the reason why Guardian’s 10/90 policy loses to both Mass & Penn in this example.

A PUA Load is an insurance company’s one-time charge you pay every time you pay new PUA premiums.

Again, I’m not sharing this to say that a company’s PUA Premium Load is the factoid you should latch onto when choosing a Whole Life policy. But it is interesting that agents pushing the 10/90 policies as the bold print of their offer are omitting this small print detail.

When a 10/90 design can be counterproductive

😶 Here’s another detail the 10/90 brigade conveniently omits:

🔒 When you get a true 10/90 design with Guardian, you’ll be locked out of max funding after about the 7th year, or sometimes sooner (depending on your age and rating).

So they wave the 10/90 flag to get you in the door, and then they upsell you to a policy with a higher base when you want the ability to keep paying.

What Matters Far More Than 10/90 When Designing Whole Life for Cash Value Performance

Let’s unpack this Base-to-PUA relationship further.

Yes, Paid-Up Additions can kickstart and turbocharge a Whole Life policy optimized for cash value performance, but most people don’t understand the following 5 facts about PUAs:

- PUAs are mini-scale models of the base policy

- But PUAs are paid up in one shot (hence the name)

- PUA premiums get added to the base’s guaranteed cash value

- PUA’s death benefit gets added to the guaranteed death benefit

- The overall Whole Life policy’s total cash value balance (including PUAs) must grow toward its total death benefit each and every day

So when IBC agents encourage you to focus on the Quantity of PUAs over the Quality of the PUAs, they are misleading you with some kind of decoy metric to suit their own agenda.

👟 It’s almost as stupid as saying that someone’s shoe size is the most important metric when choosing a spouse for a lifelong commitment!

🎯 Furthermore, leading you to believe that Whole Life’s Base Policy is like some kind of necessary evil to be minimized is a downright lie that will lead you to buying some kind of lackluster policy where both the Base Policy & PUAs underperform what you could’ve had from the start.

🙅 Don’t fall for it!

To clarify, I’m also not saying you shouldn’t get Guardian.

If you’re looking for the ultimate Flexible PUA rider, then Guardian is ideal, whereas Mass requires a maximum PUA payment once every 3 years, and Penn requires you to pay at least once in every 5 years.

Also, if Long-Term-Care is important (beyond a free chronic illness rider like both Penn & Guardian offer stock), Guardian has the best true LTC rider which also happens to be an incredibly inexpensive add-on.

Guardian just revamped their 10-Pay policy to be more competitive, and hopefully they’ll do some of the same retooling with their L99 and L95 policies soon.

Here's How to Choose a Whole Life Company or Companies For Your Family Banking Portfolio...

- It should be a highly personalized and customized process.

- It should begin w/ learning about you & educating about your options

- It should end with stress-testing the top-performing policies on the different bodies in your family you want to insure to see which is optimal.

If you want to work with a team of agents who are committed to shopping the market and custom-fitting you with the very best options, then book yourself a free discovery call here.

John “Hutch” Hutchinson, ChFC®, CLU®, AEP®, EA

Founder of BankingTruths.com