About The Banking Truths Team

Let’s face it, the financial industry is known for making things overly complicated for consumers. And you always have to wonder if the recommendations of these financial salesman are really in your best interest or theirs.

We pride ourselves on taking an education-only approach with our clients, who are often extremely intelligent people in their own professional realms. We found that when we simplify the learning process for our future clients, the truth about using properly-designed life insurance policies to maximize their pensions is undeniable.

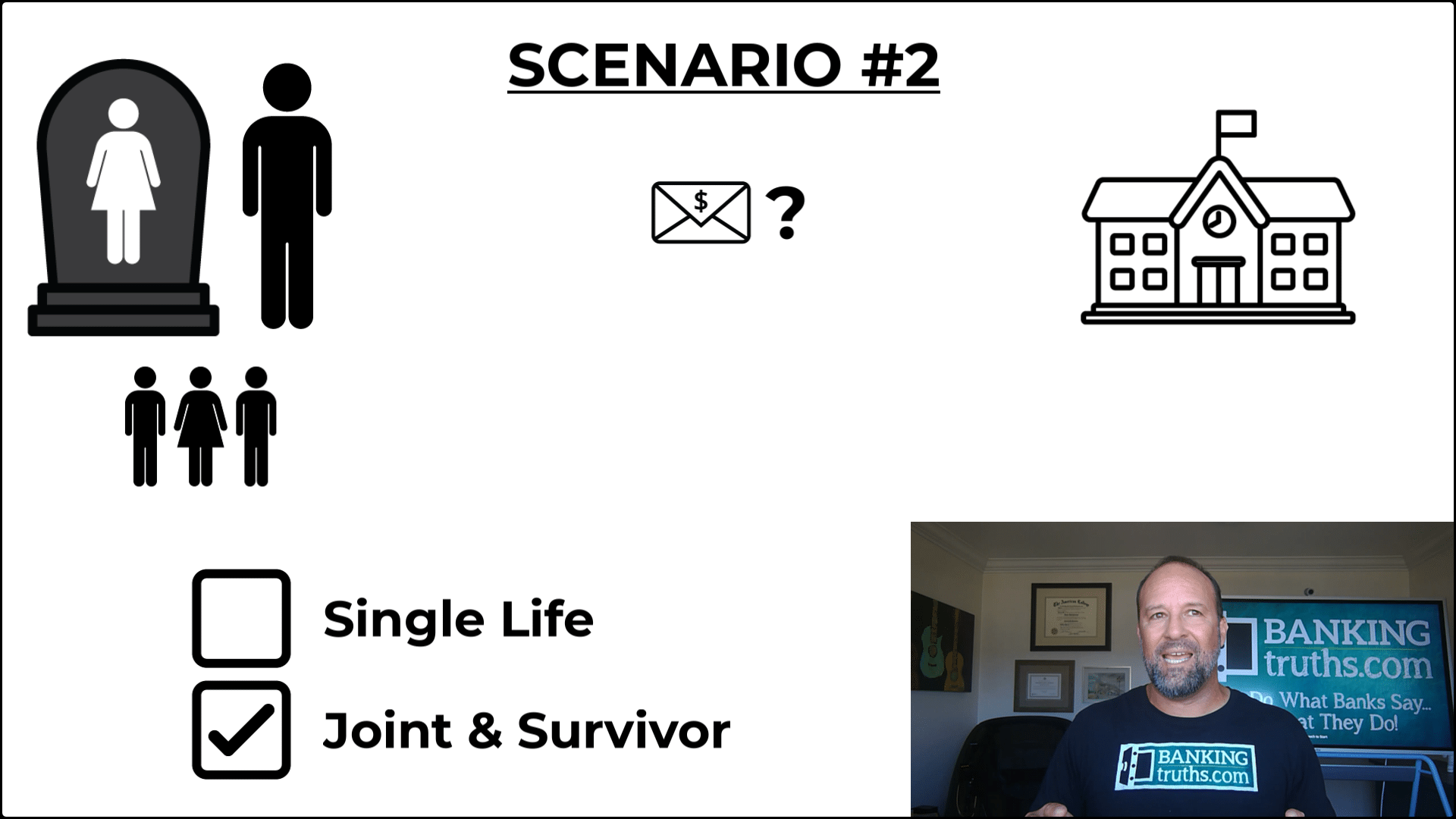

From that point, it’s simply about helping them model their proposed pension plan and helping them to elect the maximum possible guaranteed income stream, while leaving their surviving spouses protected in case they pass away prematurely in retirement.

We’re often happy to have an initial chat and see if this makes sense for you. Click here to book a free Zoom call, or you can keep reading about our team, mission, and values below.

CLICK ANY OF THE PLUS SIGNS (+) BELOW TO EXPAND & LEARN MORE

(Click on the designation acronyms after my name below for links to their full descriptions.)

John “Hutch” Hutchinson – ChFC®, CLU®, AEP®, EA (Inactive)

John, or “Hutch” as he’s often known as, is the founder of BankingTruths.com. He is not only a provider for the pension maximization strategy, but also a customer himself. You see, his wife Jessica, whom he met in the 2nd grade, is a kindergarten teacher and has taught since graduating college.

Hutch specializes in taking a visual educational approach with clients, boiling down complex financial strategies to simple sketches and stories that they can easily understand. He is also a perpetual student in the continually evolving subject of wealth creation/preservation.

Although he has earned some of the most respected classifications in the financial industry, Hutch learned some of the hardest lessons first as a consumer. You see, Hutch watched his father’s life’s work as a successful entrepreneur come unraveled due to a premature death coupled with a lack of proper estate planning.

Hutch lives in Laguna Niguel, California with his wife Jessica of over 21 years. They have three daughters and enjoy going on travel adventures together as well as playing competitive pickleball, and being of service through their church and other local causes.

Ben was initially drawn to the financial industry from his college years when he first began to invest his own money. He first subscribed to the Wall Street Journal at age 18. While taking coursework on economics and the financial planning process his intrigue and interest grew. Ben began his first job in the financial services industry in 2006 when he graduated from Point Loma Nazarene University in San Diego.

Ben was initially drawn to the financial industry from his college years when he first began to invest his own money. He first subscribed to the Wall Street Journal at age 18. While taking coursework on economics and the financial planning process his intrigue and interest grew. Ben began his first job in the financial services industry in 2006 when he graduated from Point Loma Nazarene University in San Diego.

In 2012, after having worked for two large financial companies, Ben saw that there was an inherent conflict of interest by working for financial companies who had their own proprietary products. Ben eventually chose leave the safety of his employment to venture into the independent realm with partner John “Hutch” Hutchinson. Together they started an independent boutique financial planning practice allowing them to objectively pursue the strategies and/or products that will best fit their clients’ financial needs.

Ben helps his clients create that same sense of confidence and freedom so they can focus on their business, family, and values knowing that their financial world is well cared for. Being in his 40’s Ben seeks to create lasting relationships by forging strategies that will safely grow and protect his clients’ wealth over the decades to come.

Today Ben lives in coastal San Diego with his wife Megan and 3 kids. They enjoy traveling together and an outdoor lifestyle where they like to bike, hike, and golf as well as being involved with their local church.

After years of stress testing a slew of financial products, Bryan became convinced that properly-structured life insurance products were often the ideal path to achieve this balance for his more conservative clients, especially if they had state or federal pension plans. This led Bryan to eventually transition over to ING Financial, which would later become Voya Financial, since they offered both investment and insurance products to their clients. During his time at Voya Financial, Bryan became more interested in showing his clients how to use life insurance as their own private bank. He eventually became an “Authorized Infinite Banking Concept® Practitioner” as he became more and more interested in using Whole Life insurance as a true, non-correlated asset class to financial markets.

In 2019, Bryan decided that he must align himself with a group which offered him true independence as a financial professional so he could continuously offer best-of-breed products and strategies to his clients without allegiance to any particular investment or insurance company. Bryan eventually bought the boutique financial planning firm that Hutch & Ben founded so he can be truly objective with his clients.

As an independent, Bryan now enjoys researching financial/insurance products of all types and crafting strategies for clients without interference from a parent company mandating him to steer clients toward their “approved product” list.

Matt Sanford is a true northern Californian. Raised in rural Petaluma 50 miles north of San Francisco, educated in mechanical engineering at UC Santa Barbara, and currently living in the San Francisco Bay Area.

After more than a decade as a successful general contractor in the demanding city of San Francisco and working on extremely complex projects, he saw first-hand how impactful finances can be on a family. Most projects ranged from 3-18 months and for $50K – $950K. Almost every client was a repeat client, which has taught him to be a trusted advisor to those he served. Take care of your clients first and the rest will follow was the lesson.

At some point in everyone’s life, you come to the realization that personal finance has a real impact on one’s entire life. That could be a huge discussion in itself, but to keep it simple, Matt got very interested in personal finance when his daughter was about 1 year old. At that time business was going really well, and with that success, financial knowledge and strategies became even more important. It all started with taxes and debt. Paying higher taxes every year as income grew, and also seeing how much debt was being paid out monthly on a mortgage, made Matt look deeper into what strategies were out there. Matt’s CPA helped on taxes, and then Velocity Banking debt paydown strategies really got Matt’s attention.

The rest is history!! Once he realized how much knowledge was out there and how many blind spots he had, he dove head-first into the world of personal finance. In 2018, he decided to change careers and here we are today…. Matt holds many investment and insurance licenses, as well as a Chartered Federal Employee Benefits Consultant (ChFEBC℠) for anyone who will have a pension in retirement.

Matt prides himself on being able to integrate investments, life insurance, real estate, and each client’s own unique logical and emotional factors into a cohesive plan. Working at a deeper level opens up more possibilities for each client’s unique situation, like pension maximization, investing, debt paydown and the biggest of all is retirement planning.

Matt’s goal is to be your financial advisor for the rest of your life, one financial decision at a time.

He enjoys spending time with his wife and two daughters. In his spare time, he enjoys learning Portuguese, 4-H volunteering, outdoors, woodworking, and participating in family activities.

Straight-Talk: A regular complement we hear from clients is how our straightforward approach and simple explanations help them quickly get to that aha-moment. We cut through the financial gibberish and give it to you straight. We excel at boiling down complex concepts and into simple stories and sketches, so you can quickly comprehend the strategy and arrive on a customized plan for your family bank.

Quality: The solvency of your own private bank is only as good as the quality of the underlying insurance product and company that backs that long-term financial promise. We pride ourselves on always leading with the best-of-breed products from the top-tier companies. These happen to be some of the biggest, the oldest, and most solvent mutual companies around. They also happen to be the stingiest companies when it comes to agent commissions, but that’s how they consistently deliver the strongest long-term policyholder value. We make it up the difference in volume from repeat business and referrals from happy clients.

Education: Hype and evangelistic salesmanship seems to be the norm amongst the “banking community.” We prefer to educate you about your options and their implications. We then let you sell yourself on what’s best for your family. Collectively our team has numerous prestigious designations in the various disciplines of planning. By educating you about banking in the context of the rest of your financial life, you can feel confident about moving forward, rather than just blindly hope you did the right thing based on a hyped-up sales pitch.

Coordination: Given our team’s balanced financial background, we understand that creating your own private family bank with life insurance is just one piece of your financial puzzle. Whereas other providers blatantly speak against traditional retirement planning, we believe that it doesn’t have to be an “either/or conversation.” In fact, we know that a properly-structured life insurance policy can often complement and enhance traditional retirement planning. We believe that optimizing the sum of the parts often produces the most powerful results for clients.

Independence: Having worked for different captive financial companies in the past, we believe that true independence is the only way to objectively serve our clients. That way, we can stay nimble as the industry evolves, we can always gravitate to the best-of-breed, and never have to be attached to any company in particular.

Our competition is often married to one or two product providers that butter their bread (not yours). By maintaining only broker contracts with the various insurance companies, we have no minimums to meet nor do we have allegiance to anyone other than our clients. We pride ourselves at staying cutting-edge with the best available products by shopping your unique fact-pattern to multiple providers to find the best possible fit for you.

Validation: We believe that every recommendation should come from testing and measuring multiple alternatives. We don’t expect you to simply just take our word for it. We are always happy to walk you through the internal due-diligence, shopping, and stress-testing that we have done on your behalf. That way you can fully understands and feel confident with our recommendations.

Service: Acquiring life insurance is traditionally a very complicated and time-consuming process. We pride ourselves on simplifying the steps for you and creating a turnkey experience, where we do as much of the heavy lifting for you as we can. We prep you for what’s to come, we alert you with updates throughout the process, and we will help you pivot and reroute when necessary to help you acquire the optimal policy for your bank.

Although you can always deal directly with the insurance company once your policy is in-force, we urge you to have us be your one-stop-shop when reviewing your policy values, adjusting your premium payments, or requesting loans. That way we can share our context and advice on the best course of action.